Minnesota Estate Planning Attorney Zachary Wiegand Named Minnesota Super Lawyer for 2023

We are pleased to announce that Minnesota Estate Planning Attorney Zachary Wiegand has been named a Minnesota Super Lawyer for 2023 by Super Lawyers Magazine

We are pleased to announce that Minnesota Estate Planning Attorney Zachary Wiegand has been named a Minnesota Super Lawyer for 2023 by Super Lawyers Magazine

There are better—and often more creative—ways to plan and divide that can avoid family squabbles over cars, jewelry, furniture and household items.

Revenue Procedure 2022-32 (2022-30 IRB 101) became effective on July 8, 2022. This guidance issued by the IRS allows certain taxpayers an extended amount of time (five years) to make a ‘portability election’ regarding estate and gift taxes.

The documents outline how the estate will be split between Lisa Marie’s family members and specify that Priscilla will be buried at Graceland as near as possible to Elvis, her ex-husband.

One of the most common misconceptions about a last will and testament is that having a will avoids the need for probate court.

Parents with resources could purchase the property for the child, but that often does not drive the right incentive. How then, do you get the funds to the child in the most responsible and tax-efficient way?

A judge in Australia ruled that a 75-year-old man had died without a will after the names of his beneficiaries were obscured by black ink on the document, according to a recent court filing.

It is important for residents and their families to understand the benefits and limitations of each program, eligibility requirements, and any additional costs associated with them.

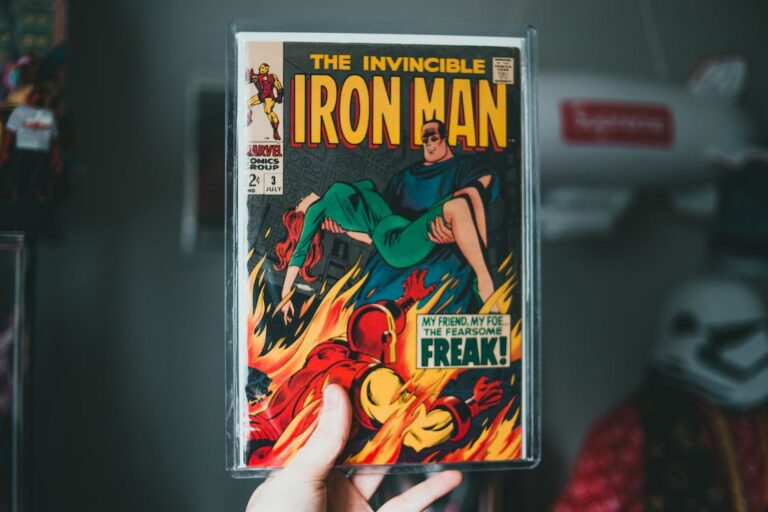

With Lee’s death, his daughter, Joan Celia Lee, known as J.C., inherited his estate but continued to pursue various legal actions attempting to get “everything that’s mine”.

As the surviving spouse, you’ll need to consider housing options, like whether to sell or keep the home, or downsize.

EXCELLENT

3000 County Road 42 W. Suite 310

Burnsville, MN 55337