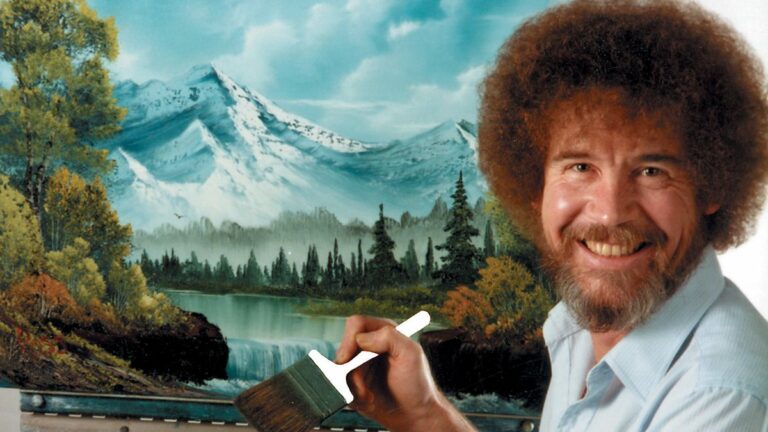

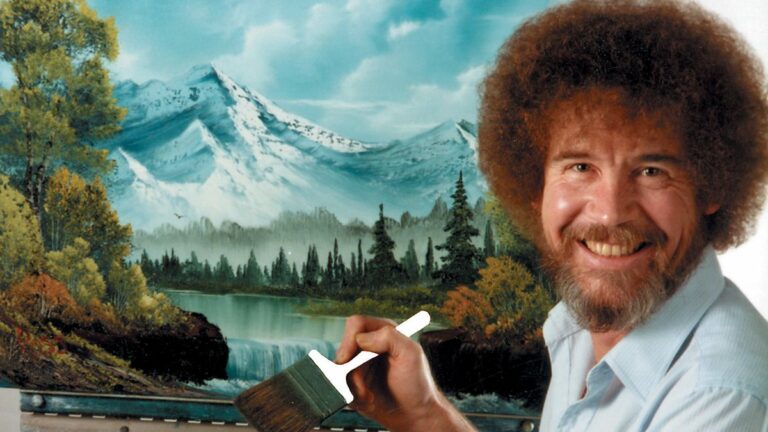

Who Inherited from the Painter Bob Ross’ Estate?

Bob Ross definitely didn’t make a happy little accident when handling his estate and his likeness after he died in 1995. He made a big mistake.

Bob Ross definitely didn’t make a happy little accident when handling his estate and his likeness after he died in 1995. He made a big mistake.

Increasingly, financial advisors are working with clients from nontraditional families, which can sometimes require different or additional strategies to protect their assets and achieve their financial goals.

Charlie Daniels played his last show before the pandemic on March 13, 2020, at the Mark C. Smith Concert Hall in Huntsville, Ala. Hunkered down at home in Mt. Juliet, Tenn., he spent the following months telling anyone who would listen — his son, journalists — that he couldn’t wait to get back on the road, where he still played up to 140 dates a year, an ambitious schedule for any artist, much less an 83-year-old.

In a lawsuit filed by Stacy Alley in a Tom Green County District Court, the woman alleges that her brother, Michael Gene Mowrey, ‘threatened her, by stating he was going to cut her throat and kill her.’

In fact, many couples with no children mistakenly believe that they are less likely to need a last will and testament than couples with children.

Every estate that holds titled property must be probated if title to that property is not transferred using some other wealth transfer method.

A trustee is a fiduciary which, essentially, is a person that owes a legal, ethical and, perhaps, moral obligation to act in the interest of another.

Perhaps one of the most difficult, and increasingly common, estate planning questions involves the inclusion or disinheritance of an estranged child.

A second marriage can be a balm for the heartache of losing a spouse, be it through death or divorce. Nevertheless, if there are children or other heirs involved, you should consider carefully what will happen with your money and possessions when you pass on.

Creating a trust as part of an estate plan can help protect assets and ensure your financial legacy is preserved. If you’re married, you may consider establishing a QTIP trust, which is short for qualified terminable interest property trust.

EXCELLENT

3000 County Road 42 W. Suite 310

Burnsville, MN 55337