Can Estate Planning Reduce Taxes?

Once more hesitant to plan ahead, clients in today’s environment are much more proactive and willing to take action in the near term, rather than waiting and risking having to pay higher taxes down the line.

Once more hesitant to plan ahead, clients in today’s environment are much more proactive and willing to take action in the near term, rather than waiting and risking having to pay higher taxes down the line.

No one likes doing taxes, but the task is even more daunting when filing a return for someone who has died.

Seeking a guardianship for a loved one is a decision that shouldn’t be taken lightly. Here’s how the process works.

When it comes to creating a will and other estate-planning documents, be aware that you probably should revisit them many times before they actually are needed.

The law requires probate for a good reason. If a person dies, probate ensures that the property goes to the people who are supposed to inherit it.

Seeking a guardianship for a loved one is a decision that shouldn’t be taken lightly. Here’s how the process works.

Of course, just because you have a living trust doesn’t mean you are all set. Here are a few of the most common mistakes people make with their living trusts.

Executors can use additional information in administering estates, especially if the executor is unrelated to the decedent.

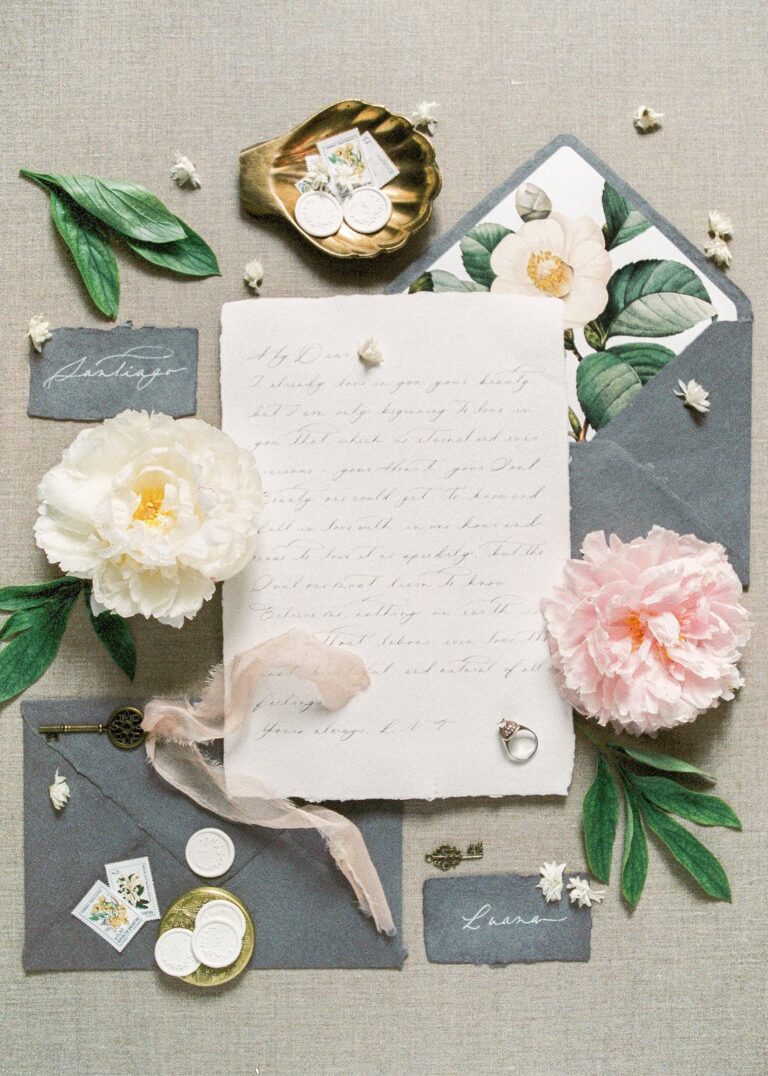

From digital assets to financial accounts to sentimental items, here’s what to think about to make sure your loved ones have access to everything they need when you pass away.

For most people, entering the realm of estate planning can feel a bit like traveling as a tourist into another culture. Because the language itself is unfamiliar, asking a question can result in an answer that is equally confusing.

EXCELLENT

3000 County Road 42 W. Suite 310

Burnsville, MN 55337